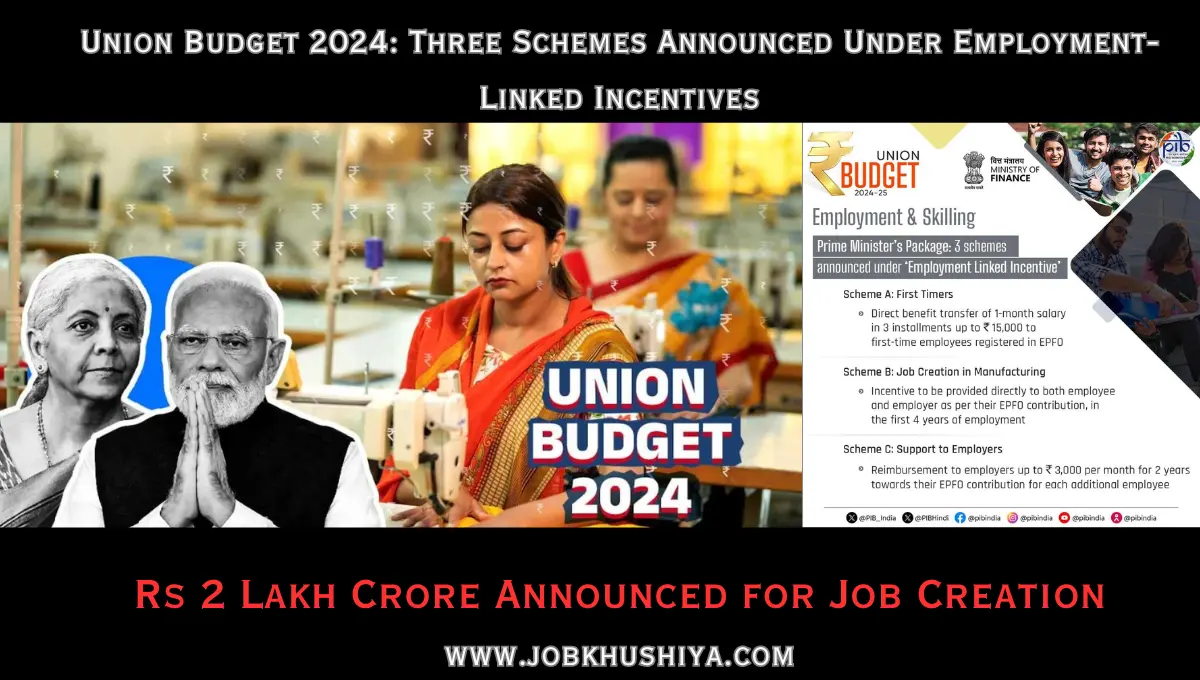

The Union Budget 2024, presented by Finance Minister Nirmala Sitharaman, is a visionary document that lays out the government’s roadmap for economic growth, job creation, and skilling. With a commitment to fostering employment opportunities and enhancing the skill sets of the Indian workforce, the budget introduces several new initiatives and incentives aimed at driving job creation and economic development. Among the key announcements are three innovative schemes under Employment-linked incentives, along with a substantial allocation of Rs 2 lakh crore for job creation over the next five years.

Introduction:

The Union Budget 2024 marks a significant milestone in India’s journey towards becoming a developed nation by 2047. Prime Minister Narendra Modi emphasized the importance of this budget in setting the direction for India’s future growth and development. The government’s focus on job creation, skilling, and economic incentives reflects its commitment to addressing the employment challenges faced by the country and empowering the youth with the skills necessary for a prosperous future.

In this blog post, we will delve into the details of the three schemes announced under Employment-linked incentives, the substantial budget allocation for job creation, and the broader implications of these initiatives for India’s economy and workforce.

Union Budget 2024: Three Schemes Announced Under Employment-Linked Incentives; Rs 2 Lakh Crore Announced for Job Creation:

Scheme A: Direct Benefit Transfer for First-Time Employees:

Scheme A aims to provide financial support to first-time employees registered with the Employees’ Provident Fund Organization (EPFO). Under this scheme, eligible employees will receive a Direct Benefit Transfer (DBT) of one month’s salary in three instalments, up to a maximum of Rs 15,000. This initiative is designed to encourage young job seekers to enter the formal workforce and gain valuable work experience.

Key Features of Scheme A:

- Eligibility: First-time employees registered with EPFO.

- Benefit: Direct Benefit Transfer of one month’s salary in three instalments, up to Rs 15,000.

- Objective: Encourage youth to join the formal workforce and reduce unemployment.

By providing a financial incentive to first-time employees, Scheme A aims to reduce the barriers to entry into the job market, making it easier for young individuals to secure employment and contribute to the economy.

Scheme B: Manufacturing Incentives for Job Creation

Scheme B focuses on promoting job creation in the manufacturing sector. This scheme provides direct incentives to both employees and employers based on their EPFO contributions during the first four years of employment. By aligning incentives with EPFO contributions, the scheme encourages sustained employment and growth in the manufacturing sector, which is a critical driver of economic development.

Key Features of Scheme B:

- Eligibility: Employees and employers in the manufacturing sector.

- Benefit: Direct incentives based on EPFO contributions for the first four years of employment.

- Objective: Promote job creation and growth in the manufacturing sector.

The manufacturing sector is a key component of India’s economy, and Scheme B aims to stimulate job creation by providing financial incentives that benefit both employees and employers. This initiative is expected to lead to increased productivity, innovation, and competitiveness in the sector.

Scheme C: Support to Employers for Additional Employees

Scheme C is designed to support employers by reimbursing a portion of their EPFO contributions for each additional employee hired. Under this scheme, employers will receive a reimbursement of up to Rs 3,000 per month for two years for each new employee added to their workforce. This initiative aims to reduce the financial burden on employers, encouraging them to expand their workforce and create more job opportunities.

Key Features of Scheme C:

- Eligibility: Employers adding new employees to their workforce.

- Benefit: Reimbursement of up to Rs 3,000 per month for two years for each additional employee.

- Objective: Encourage employers to hire more workers and expand their operations.

By providing financial support to employers, Scheme C incentivizes businesses to grow and create more jobs, contributing to the overall economic development of the country.

Skilling Initiatives and Support for Higher Education:

In addition to the employment-linked incentives, the Union Budget 2024 also emphasizes the importance of skilling and higher education. The government announced a new centrally-sponsored scheme for skilling 20 lakh youth over the next five years. This initiative will be implemented in collaboration with states and industry, ensuring that the training provided is relevant to the needs of the job market.

Key Features of the Skilling Initiative:

- Target: Skilling 20 lakh youth over five years.

- Collaboration: Implemented in partnership with states and industry.

- Objective: Equip youth with relevant skills for the job market.

To further support skilling efforts, 1,000 Industrial Training Institutes (ITIs) will be upgraded on the hub-and-spoke model. This model will enhance the quality of training provided and ensure that ITIs are better equipped to meet the demands of the industry.

Support for Higher Education:

The government will also provide financial support for loans up to Rs 10 lakh for higher education in India. Additionally, the model skilling loan scheme will be revised to facilitate loans up to Rs 7.5 lakh. These measures aim to make higher education more accessible and affordable, enabling more students to pursue advanced studies and acquire the skills needed for high-paying jobs.

Impact on the Job Market:

Economic Growth and Job Creation

The substantial allocation of Rs 2 lakh crore for job creation over the next five years is expected to have a significant impact on the Indian job market. By promoting economic growth and encouraging businesses to expand their workforce, the budget aims to create a conducive environment for job creation.

Increased Employment in Manufacturing

The manufacturing sector, being a critical driver of economic development, stands to benefit significantly from the incentives provided under Scheme B. By aligning incentives with EPFO contributions, the scheme encourages sustained employment and growth in the sector, leading to increased productivity, innovation, and competitiveness.

Enhanced Skilling and Employability

The focus on skilling and higher education will address the skills gap and enhance the employability of the Indian workforce. The skilling initiatives and financial support for higher education will equip youth with the necessary skills to thrive in a rapidly evolving job market.

Support for Employers

The support provided to employers under Scheme C will reduce the financial burden on businesses and encourage them to hire more workers. This will not only create more job opportunities but also contribute to the overall economic development of the country.

Conclusion:

The Union Budget 2024 presents a comprehensive and forward-looking approach to job creation, skilling, and economic development. The three schemes announced under Employment-linked incentives, along with the substantial allocation of Rs 2 lakh crore for job creation, demonstrate the government’s commitment to addressing the employment challenges faced by the country and empowering the workforce with the necessary skills.

By providing direct financial support to first-time employees, promoting job creation in the manufacturing sector, and supporting employers in expanding their workforce, the government aims to create a conducive environment for economic growth and development. The skilling initiatives and support for higher education further underscore the importance of equipping the youth with the skills needed to thrive in a rapidly evolving job market.

As India moves towards its goal of becoming a developed nation by 2047, the measures outlined in the Union Budget 2024 will play a crucial role in shaping the country’s future and ensuring that it remains on a path of sustained growth and prosperity.